ibee studer has lauched solar activities in Western Africa after site visits in October 2018, partnering with Solafrique SARL in Burkina Faso (financing solar water pumping projects) and Ameen Africa SARL in Benin (financing solar systems for laundries, homes and refrigerators). Since mid 2019, ibee swiss renewable energy investments (pvt) ltd is our daughter company in Sri Lanka, financing commercial solar rooftops.

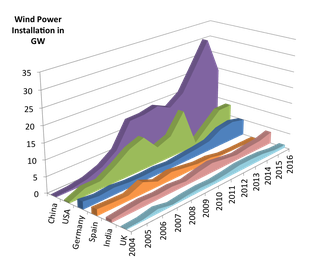

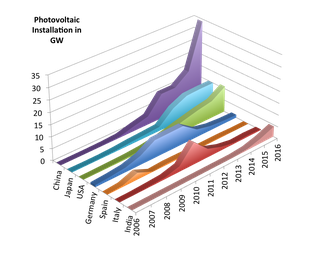

While Germany was leading the development of renewable energies between 2005 and 2012, China is obviously dominating the renewable energy market in recent years. Teaching renewable energy marketing for international students I try to keep an overview of the development and am interested to look into business opportunities for a clean energy future. (Link MBA Renewables by Renac & Beuth Hochschule)

Competitiveness of renewable energy in the power grid

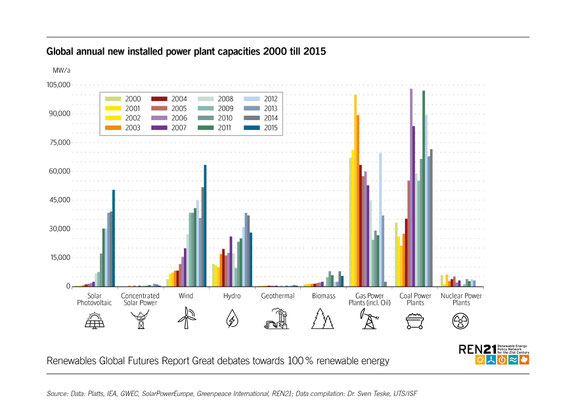

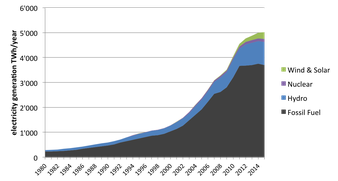

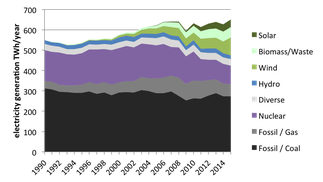

In the last several years, and mainly thanks to government initiatives, there has been significant growth in some renewable energy capacities. In 2015, renewable energy accounted for 60% (147 GW) of all new generating capacity installed worldwide (ren21.net, 2016). The following graph shows the growing role of wind and solar power.

The general situation of the power sector has to be considered and is significantly different in developing countries than in Europe or the USA. The economic development of China was powered by an exponentially growing power generation.

The Chinese government is well aware of the negative impact of coal, however, a growing energy demand has to be covered. Around 1990, about the same amount of electricity was produced in China and Germany. Today China produces 8 times more, while the generation in Germany is not predicted to grow significantly. Since about 2012, the utilization rate of Chinese coal power plants is decreasing and the number of new plants is shrinking, while wind and solar power prove to be the affordable sources to be scaled up in short time.

To a large extent, the growing share of renewables in Europe is not owned and controlled by the traditional utility companies. While Hanergy emerged from a Chinese utility to beomce a global supplier of solar modules, many European utilities struggle to find a new role while confronted with reduced electricity sales. Some utility companies step into new business, e.g. selling grid services for prosumers (consumers with own production) – for example, the Swiss utility BKW purchased the German PV monitoring and control provider Solar-Log, meaning it now has access to a big pool of data and thousands of potential new customers. By vertical integration – e.g. purchasing PV installation companies – they are also becoming serious competitors for once pioneering solar players.

On the other hand, many utilities try to keep new entrants out of business, e.g. with high metering costs, permits or regulations introduced by way of influencing politics. Issues like oversupply in peak hours and grid management are highlighted. Old nuclear and coal power plants have not been switched off yet, and as a consequence the oversupply reduces prices on the European Energy Exchange below 4 EUR-cents/kWh so that not only renewables but also other new plants cannot cover their costs on the open market. When grid parity is reached, the dependency on political support is reduced. Nonetheless, the electricity market is to some extent regulated and options to limit the attractiveness of decentralised power production remain (e.g. new taxes on self consumption and flat rate electricity tariffs are discussed).

New fossil fuel power has generation costs in a range of 4.5 to 14 US-cents/kWh - excluding health and carbon emission costs. The weighted average investment cost for onshore wind fell by two-thirds between 1983 and 2015, the estimated generation cost fell from 38 to 6-8 US-cents/kWh. Solar electricity is generated below 5 US-cents/kWh in India, the Middle East and South America.